How does double declining depreciation front-load your expenses and reduce tax? This aggressive depreciation method allows businesses to maximize deductions early on for assets that lose value quickly. This article dispels the complexity around double declining depreciation and guides you through its application, showcasing when leveraging this method can be most beneficial for your financial strategy without getting too technical.

Key Takaways

The double declining balance method is an accelerated depreciation technique, allowing for larger depreciation expenses in the early years of an asset’s life, reflecting its faster loss of value and allowing for deferred tax liabilities.

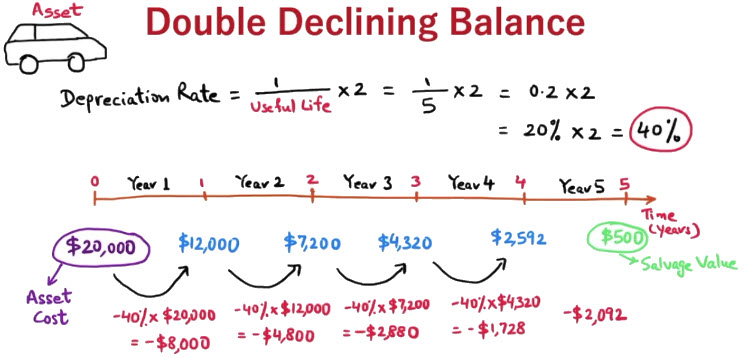

Calculating depreciation using the double declining balance involves doubling the straight-line depreciation rate and applying it to the asset’s book value at the beginning of each year, thus front-loading the depreciation expenses.

While the double declining balance method can improve cash flow by increasing initial tax deductions, it also complicates accounting and forecasting, and may present a less favorable view of assets early on.

Understanding Double Declining Balance Depreciation

Within the accounting sector, the double declining balance method operates much like a skilled sprinter bursting forth with speed from the starting line and then settling into a consistent stride as they near the end of the race. Known alternatively as just ‘double declining,’ this approach is an accelerated depreciation technique that concentrates depreciation expenses more heavily in an asset’s initial years. This front-loading effect aligns with how many assets typically diminish in value at a faster rate when they are fresh out of production, thereby allowing companies to account for this rapid early decline using the double declining method.

Accelerated Depreciation Explained

The double declining balance, an esteemed accelerated depreciation method, operates on the premise that some assets are analogous to meteors in their fleeting yet intense utility. They provide the highest value shortly after acquisition and then experience rapid deterioration due to constant use. The approach of this depreciation method is structured so as to allocate larger depreciation expenses early in the asset’s lifespan, mirroring its real-world wear.

Such substantial initial deductions for depreciation serve as a strategic fiscal tool by postponing tax obligations and offering financial leeway during the early years when earnings are typically at their peak.

Double Declining Balance vs. Straight Line Method

Imagine a competition between two athletes: one sprints ahead rapidly, while the other maintains a steady pace. This scenario is akin to how the double declining balance method front-loads depreciation expenses during the earlier years of an asset’s life cycle, in contrast to its more uniform peer, the straight line method. The straight-line approach evenly distributes expenses much like butter spread across bread throughout an asset’s useful life and is valued for its straightforwardness and predictability.

Yet this regular distribution does not always reflect actual circumstances where assets may lose value at an accelerated rate soon after acquisition—akin to vehicles that depreciate swiftly as they are driven off the car lot.

The Double Declining Balance Formula and Calculation

The double declining balance method enhances the process of calculating depreciation by amplifying the straight-line depreciation rate—simply the inverse of an asset’s useful life. By multiplying this rate by two, it generates a heightened depreciation expense which is then applied to the starting book value each year, enabling one to figure out the annual depreciation cost.

Basic Depreciation Rate Calculation

Getting more into the specifics, imagine you possess a business vehicle that is subject to a 5-year recovery period as determined by the IRS. To ascertain the annual depreciation using straight-line depreciation, one would simply divide the cost of the vehicle by this 5-year time span.

When applying the double declining balance method, you amplify this process: take that same annual depreciation derived from straight line calculation and ramp it up twofold. This intensified rate becomes your basic depreciation rate and serves as a crucial reference for initiating computations with our double declining balance formula to calculate depreciations in an accelerated manner.

Book Value Determination

The financial health of an asset can be gauged by its book value, a figure that represents the present value after accounting for continuous depreciation. This is determined by subtracting the accumulated depreciation from the asset’s initial cost. The double declining balance method particularly accelerates this decrease in value.

Upon reaching full depreciation, an asset’s book value effectively diminishes to zero and all that remains is the estimated salvage value which was anticipated at the outset.

Advantages of Using Double Declining Balance Depreciation

The double declining balance method is not just a resource for accountants. It acts as an essential strategic asset within the business realm. This technique provides a plethora of benefits, including accelerated tax deductions that enable companies to protect more income from taxation in the early high-revenue years of the asset’s life. It coincides neatly with how assets are actually used, bringing lower maintenance expenses at first and consequently enhancing a company’s cash flow.

This methodology embraces the reality that certain assets – consider our example of an upscale printer – will inevitably experience rapid depreciation.

Potential Drawbacks of Double Declining Balance Depreciation

The double declining balance method is not without its complications. Its complex computations may prove more challenging than the straight-line method’s straightforward approach, raising the possibility of mistakes and added complexity. Due to fluctuations in annual deductions with this approach, forecasting profits can become unpredictable.

Companies could also regret opting for this depreciation technique if unexpected events occur that lead to increased future tax obligations. By front-loading depreciation expenses through double declining balance accounting techniques during a company’s initial years of asset acquisition can result in a seemingly diminished valuation of those assets on the balance sheet early on.

Real-Life Example: Applying Double Declining Balance Depreciation

Transitioning from theoretical concepts to their practical application, consider a company that acquires a delivery truck for $30,000 with an expected useful life of 10 years and a residual value of $3,000. In the inaugural year applying the double declining balance method, it incurs a depreciation expense of $6,000. This initial deduction substantially decreases the truck’s book value immediately. As time elapses using this approach at a rate of 20%, applied to ever-diminishing book values each year leads to progressively smaller annual depreciation expenses.

Ultimately when the vehicle completes its tenure delivering goods under its belt by reaching end-of-service life and adheres closely to its anticipated salvage value—fulfilling its economic role within the financial expectations laid out for such assets.

Switching Between Depreciation Methods

Accountants have the discretion to change from using the double declining balance method to employing the straight-line method when it results in a greater depreciation expense for any particular year. This transition needs solid reasoning behind it so that compliance with accounting principles and tax regulations is maintained.

When performing this adjustment, meticulousness and attention are critical as all financial statements must be updated to accurately demonstrate this shift in calculating depreciation.

Choosing the Right Depreciation Method for Your Business

Selecting the right depreciation method is a strategic decision that requires an in-depth understanding of both your company’s assets and its financial goals. For assets like advanced technology devices or equipment susceptible to becoming obsolete quickly, the double declining balance method is particularly advantageous because it accounts for their swift loss in value.

It’s crucial that any chosen depreciation approach not only aligns with your business’s financial tactics but also meets regulatory requirements. This ensures that the method withstands close examination and benefits the long-term prosperity of your organization.

Wrap up

As we draw this guide to a close, it’s clear that the double-declining balance method is a powerful tool for managing asset depreciation. It offers businesses the agility to maximize tax benefits early on while aligning depreciation expenses with the actual decline in asset value. However, its complexity and the potential for future financial implications mean it’s not a one-size-fits-all solution.

Embrace the method that best suits your business’s needs, and let it steer you towards a future of well-managed assets and financial clarity. After all, depreciation shouldn’t be a drawback; with the right approach, it can become a strategic advantage, paving the way for sustainable growth and financial success.

Frequently Asked Questions

What exactly is the double declining balance depreciation method?

Using the double declining balance method, an accelerated depreciation approach is applied to compute depreciation expense, which results in a larger depreciation amount during the initial years of an asset’s life. The expense diminishes with each passing year under this system. It’s commonly employed for assets that experience rapid value degradation early on.

How do I calculate the basic depreciation rate for the double declining balance method?

To determine the basic depreciation rate using the double declining balance method, you initially ascertain the straight-line depreciation by dividing the asset’s cost by its useful life. Subsequently, this figure is multiplied by two to establish your double declining balance depreciation rate.

What are the main benefits of using the double declining balance method?

The double declining balance method offers tax advantages by allowing for greater purchase cost coverage initially and aligning with maintenance expenses, which in turn lowers tax liabilities while assets are yielding higher income during the early years.

Can I switch from the double declining balance method to another depreciation method?

Transitioning from the double declining balance approach to a different depreciation method is permissible when it leads to an increased depreciation expense while adhering to accounting principles and tax laws. Such a change must be thoughtfully evaluated in order to align with both your financial objectives and legal obligations.

What should I consider when choosing a depreciation method for my business?

Take into account the nature of your assets, fiscal goals, and compliance with legal standards when selecting a depreciation method that is in harmony with the necessities of your company.