Internal Controls

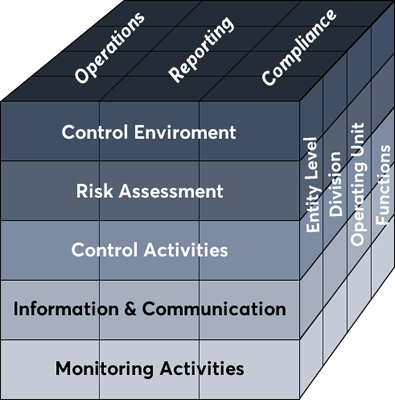

Internal controls are the mechanisms, rules, and procedures implemented by a company to ensure the integrity of financial and accounting information.

Internal control is an interlocking set of activities that are layered onto the normal operating procedures of an organization, with the intent of safeguarding assets, minimizing errors, and ensuring that operations are conducted in an approved manner. Another way of looking at internal control is that these activities are needed to mitigate the amount and types of risk to which a firm is subjected.

Effective internal control reduces the risk of asset loss, and helps ensure that information is complete and accurate, financial statements are reliable, and the plan’s operations are conducted in accordance with the provisions of applicable laws and regulations. When internal control is effective, you have reasonable assurance that your organization is achieving its financial reporting objectives. When it is not effective, you have little or no such assurance.

Why Do I Need Internal Controls?

An effective system of internal control protects

your operations in two ways:

1. Prevention

2. Detection

01

By minimizing opportunities for unintentional errors or intentional fraud that may harm the plan. Preventive controls, which are designed to discourage errors or fraud, help accomplish this objective.

02

By discovering small errors before they become big problems. Detective controls are designed to identify an error or fraud after it has occurred.

Internal control is all of the policies and procedures management uses to achieve the following goals:

Safeguard assets

Well designed internal controls protect assets from loss. The objective is to guard against loss of assets because of theft, accidental destruction, fraud, and errors. Assurance must exist that transactions related to assets have been properly processed and that appropriate physical handling and control over assets exist.

Ensure the reliability and integrity of financial information

Internal controls ensure that management has accurate, timely and complete information, including accounting records, in order to plan, monitor and report business operations. Stakeholders will have more confidence in your financials. Internal controls and/or Sarbanes-Oxley (SOX) compliance indicates a stronger investment. By implementing internal control structures prior to going public or being purchased, the company can save costs and reduce the number of challenges during a sale.

Ensure compliance

Organizations are tasked with providing proper risk prevention practices and effective internal controls for operations, finance, HR, strategy, and legal to ensure all corporate compliance obligations are met. Internal controls ensure compliance with laws and regulations and accurate and timely financial reporting and data collection, as well as helping to maintain operational efficiency by identifying problems and correcting lapses before they are discovered in an external audit.

Promote efficient and effective operations

Internal controls provide an environment in which managers and staff can maximize the efficiency and effectiveness of their operations. No two systems of internal controls are identical, but many core philosophies regarding financial integrity and accounting practices have become standard management practices. While internal controls can be expensive, properly implemented internal controls can help streamline operations and increase operational efficiency, in addition to preventing fraud.

Accomplishment of goals and objectives

Internal controls system provide a mechanism for management to monitor the achievement of operational goals and objectives. Ultimately, management is responsible for the financial statements and operation of a business. Good internal controls provide a higher level of assurance to management and stakeholders.

What Are Internal Controls?

Internal controls are the mechanisms, rules, and procedures implemented by a company to ensure the integrity of financial and accounting information, promote accountability, and prevent fraud. Besides complying with laws and regulations and preventing employees from stealing assets or committing fraud, internal controls can help improve operational efficiency by improving the accuracy and timeliness of financial reporting.

Why Companies need to Have Internal Controls

Internal controls have become a key business function for every U.S. company since the accounting scandals in the early 2000s. In their wake, the Sarbanes-Oxley Act of 2002 was enacted to protect investors from fraudulent accounting activities and improve the accuracy and reliability of corporate disclosures. This has had a profound effect on corporate governance, by making managers responsible for financial reporting and creating an audit trail. Managers of public companies found guilty of not properly establishing and managing internal controls face serious criminal penalties.

Sarbanes-Oxley Compliance

Pre-IPO

When your company is preparing to go public, you’ve got a lot on your mind. Let us help you ease the burden by establishing and executing a project plan to guide you through the complexities of regulatory compliance.

Public Companies

SOX compliance costs are significant for most companies. We can help reduce your financial (and opportunity) cost of compliance through tailored automation, system implementation and configuration, and strategic support.

Our Clients

Partner with an Experienced Internal Control Service Provider!

Let our team of experts handle the accounting and financial reporting so you can focus on what you love to do – growing your business.